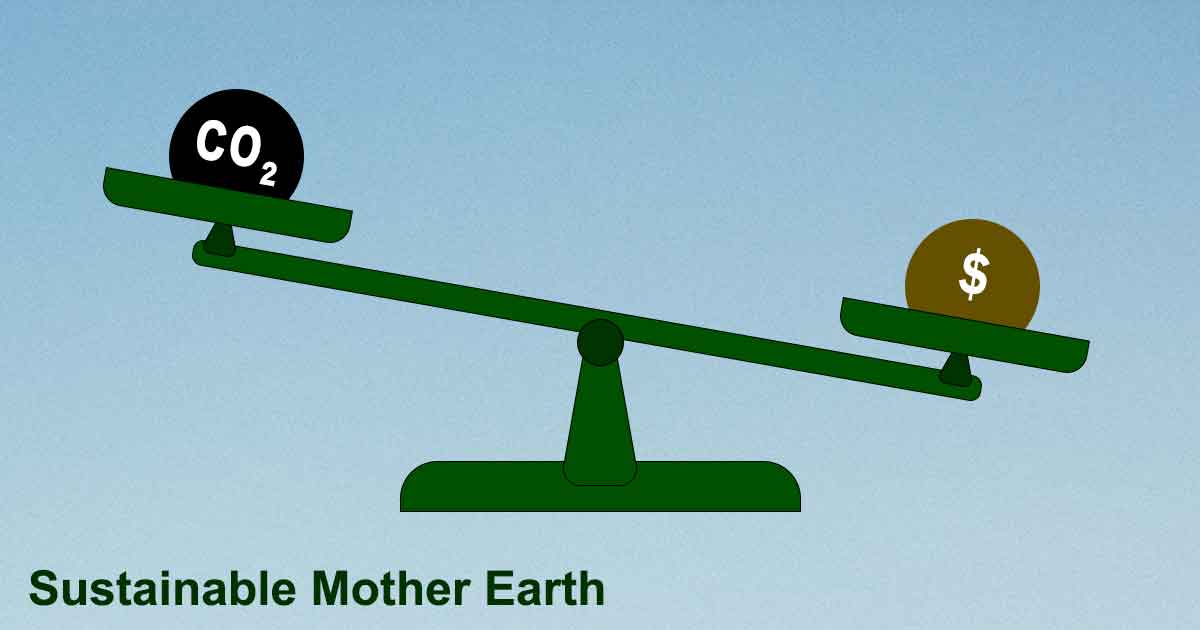

Carbon pricing has emerged as a powerful tool in the fight against climate change. By placing a price on carbon emissions, governments and companies can incentivize emissions reductions and fund the development of renewable energy sources. In this article, we explore what carbon pricing is, how it works, and its impact on sustainability.

What is Carbon Pricing?

Carbon pricing is a policy mechanism that places a price on carbon emissions. The idea behind carbon pricing is to create a market-based incentive for reducing carbon emissions by making it more expensive to emit carbon.

Forms of Carbon Pricing:

The main forms of carbon pricing are carbon taxes and cap-and-trade systems.

Carbon taxes:

A carbon tax is a direct tax on carbon emissions. Companies or individuals are charged a fee for each ton of carbon dioxide they emit. The purpose of the tax is to encourage companies to reduce their carbon emissions by making it more expensive to emit carbon. The revenue generated from the carbon tax can be used to fund research into renewable energy or to subsidize the development of clean energy technologies.

Cap-and-trade systems:

Cap-and-trade is a market-based approach to reducing carbon emissions. Under a cap-and-trade system, the government sets a limit or cap on the amount of carbon dioxide that can be emitted by a particular industry or sector. Companies are then issued permits or allowances that allow them to emit a certain amount of carbon dioxide. If a company emits more carbon dioxide than it has permits for, it must purchase additional permits from other companies that have emitted less than their allotted amount.

How Does Carbon Pricing Impact Sustainability?

Carbon pricing is a powerful tool for promoting sustainability. By placing a price on carbon emissions, companies and individuals are incentivized to reduce their carbon footprint. This can be achieved by investing in renewable energy sources, increasing energy efficiency, or developing new technologies that reduce emissions.

Carbon pricing can also generate revenue that can be used to fund sustainable initiatives. For example, revenue from carbon taxes can be used to fund research into renewable energy technologies or to subsidize the development of clean energy sources. Revenue from cap-and-trade systems can be used to fund energy efficiency programs or to support the development of sustainable infrastructure.

Carbon pricing can also drive innovation in the clean energy sector. By creating a market-based incentive for reducing emissions, companies are encouraged to invest in new technologies that reduce emissions. This can lead to the development of new and innovative technologies that can help drive the transition to a low-carbon economy.

However, there are also concerns about the impact of carbon pricing on low-income households. Carbon pricing can lead to higher energy costs, which can disproportionately impact low-income households. To address this, some governments have implemented policies to offset the impact of carbon pricing on low-income households, such as rebates or subsidies

Benefits of Carbon Pricing

Carbon pricing is a policy tool that can bring about a range of benefits for both the environment and the economy. Here are some of the benefits of carbon pricing:

Encourages Emissions Reduction:

Carbon pricing incentivizes companies to reduce their carbon emissions by making it more expensive to emit carbon. Companies that reduce their carbon emissions can also sell any unused allowances on the carbon market, providing them with additional revenue.

Promotes Energy Efficiency:

By increasing the cost of carbon emissions, carbon pricing encourages companies to become more energy-efficient, reducing their energy costs and carbon footprint.

Drives Innovation:

Carbon pricing can encourage investment in new technologies that reduce emissions, such as renewable energy and carbon capture and storage (CCS).

Generates Revenue:

The revenue generated from carbon pricing can be used to fund research into renewable energy technologies, support the development of sustainable infrastructure, or provide rebates to low-income households.

Helps Achieve Climate Targets:

Carbon pricing can help countries and companies achieve their climate targets by reducing emissions and promoting sustainable practices.

Creates Jobs:

Investment in renewable energy and sustainable infrastructure can create new jobs in the clean energy sector.

Improves Air Quality:

Carbon pricing can reduce the use of fossil fuels, improving air quality and reducing the incidence of respiratory illness.

Increases Energy Security:

By promoting the development of renewable energy sources, carbon pricing can reduce dependence on fossil fuels and increase energy security.

Supports Sustainable Development:

Carbon pricing can provide funding for sustainable development projects, such as renewable energy and clean water initiatives.

Provides Transparency:

Carbon pricing provides a transparent mechanism for pricing the cost of carbon emissions, enabling companies and individuals to better understand the true cost of their carbon footprint.

Challenges Associated with Carbon Pricing

While carbon pricing can bring about a range of benefits, there are also several challenges associated with implementing carbon pricing policies. Here are some of the key challenges:

Political Opposition:

Carbon pricing can be politically unpopular, particularly among industries that rely heavily on fossil fuels. As a result, some governments may be hesitant to implement carbon pricing policies that could harm their electoral prospects.

Regulatory Complexity:

Carbon pricing can be complex to implement, particularly if multiple jurisdictions or countries are involved. Developing a system for monitoring and enforcing emissions reductions can be challenging, and there is always the risk of loopholes or gaming the system.

Economic Impacts:

Carbon pricing can have significant economic impacts, particularly on industries that rely heavily on fossil fuels. Some argue that carbon pricing could lead to job losses in certain sectors, and that low-income households may be disproportionately affected by higher energy prices.

Carbon Leakage:

Carbon pricing policies may not be effective if companies simply move their operations to countries with less stringent regulations. This phenomenon is known as carbon leakage, and it can undermine the effectiveness of carbon pricing policies.

Implementation Costs:

Implementing carbon pricing policies can be expensive, particularly if significant investments are required to upgrade infrastructure or develop new technologies.

Distributional Impacts:

Carbon pricing can have distributional impacts, meaning that some groups may be affected more than others. For example, low-income households may be more vulnerable to energy price increases, while high-income households may be able to afford any additional costs associated with carbon pricing.

Volatility:

Carbon pricing can be volatile, particularly if there is uncertainty surrounding future policy developments or changes in market conditions. This volatility can make it difficult for companies to plan investments or make long-term commitments.